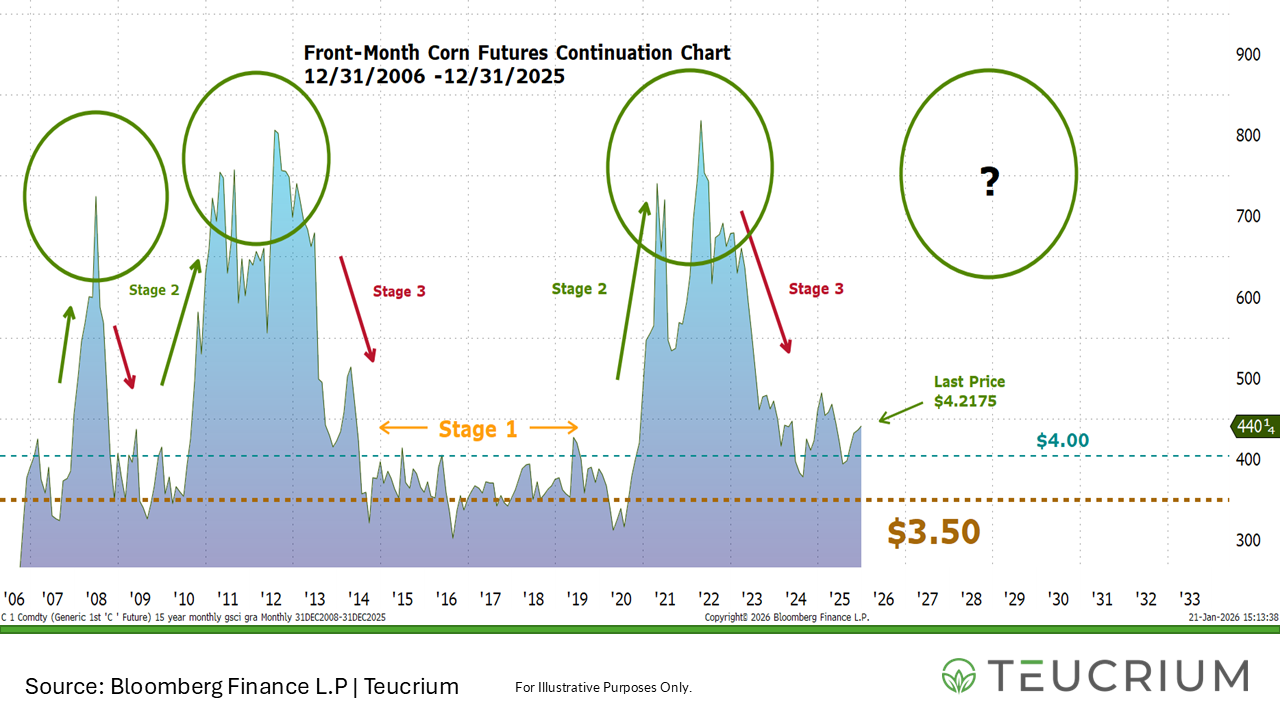

Current Stage

Prices are trading around production cost levels

"Grains tend to trade at or near their cost of production until there is a supply disruption at which point prices historically have moved dramatically higher.

Over time as production increases and/or demand decreases, inventories are rebuilt and prices trend back toward the cost of production once again.”

– Sal Gilbertie

Prices trade at or near the cost of production

Prices Advance Amid supply/demand imbalance

Supplies build due to increased output and prices head back toward the cost of production

Current Stage

Prices are trading around production cost levels

For additional market commentary please follow us on X @TeucriumETFs, and LinkedIn, and subscribe to our market commentary

The information provided along with associated documents is intended to provide a broad overview for discussion purposes. It is subject to change and should not be taken as financial or investment advice. Teucrium Trading LLC and Teucrium Investment Advisors, LLC make no offers to sell, solicitations to buy, or recommendations for any security, nor do they offer advisory services.

Past performance is not indicative of future results. Teucrium disclaims any liability for any actions taken based on the information provided in this document.